In our last post: https://www.discretionarydystopia.com/mind-the-volatility-gap-spread/

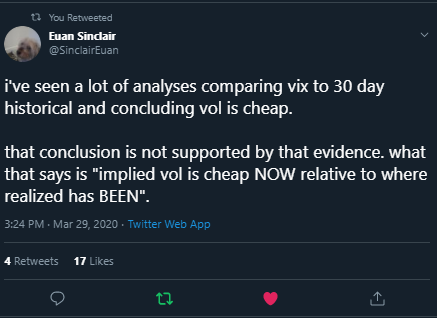

We described that the VIX index should be thought of relative to historical volatility. And as such, people pointed out that it is an expectation of future volatility, not historical volatility. As an example from Euan, whom I have learned a significant amount from just reading his books, not to mention pestering him on Twitter.

That is of course absolutely correct, but our best guess of the future can only come from the past. Instead of just telling you this is a fact, in this post we will show you: The VIX is better related to Historical Realized Volatility (HRV) than it is to Subsequent Realized Volatility (SRV). In addition to the above motivation for writing this post, we take the following from SqueezeMetrics Gamma Exposure (GEX) White paper

https://squeezemetrics.com/download/white_paper.pdf:

Unfortunately, the quoted paper – linked here has mysteriously disappeared from the CBOE website:

So we have done our own analysis below:

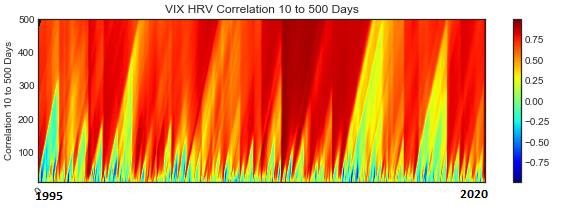

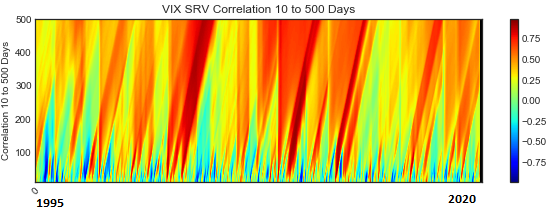

Our first chart shows the correlation between the VIX and 1 month Historical Realized Volatility. Instead of taking one time period to capture correlation, we take ALL the time periods. This makes more sense to us, in that we do not think correlation should be defined by one time period, but rather it should be averaged over multiple time periods. With that said the Y axis is correlation, for every time period from 10 days to 500 days, in ten day increments. The X axis is dates: The data starts in January 1995, and goes to the close Friday – March 27, 2020. Adding date labels to this chart is a pain, so we will try to provide context without the date labels.

What stands out immediately from this chart is that on lower time frames correlations (say 10 to 100 days) are not strong between VIX and 1 month Historical Realized Volatility – however on higher time frames correlations are strong. The numbers suggest the following:

If you average all the colors on the chart above the 100 day time period you get a correlation of .73. If you average everything at 100 days and below you get a correlation of .35. Ok, we are confident that VIX follows HRV much better on higher time frames than it does on lower time frames.

Our second chart shows the correlation between the VIX and 1 month Subsequent Realized Volatility. Using our “Chi by Eye” (thanks Euan) we notice that the relationship is significantly different.

If you average all the colors on our second chart above the 100 day time period you get a correlation of .41 If you average everything at 100 days and below you get a correlation of .13.

So who do you trust? It should be obvious now.

While relationships under 100 days are weak on both fronts – the VIX relationship overall appears to be biased towards Historical Realized Volatility rather than Subsequent Realized volatility.

“implied vol is cheap NOW relative to where realized has BEEN”. YES, but who do you trust more?

Thanks, until next time.

If you enjoyed this post, follow us on twitter @discdystopia and subscribe for email updates (top right).