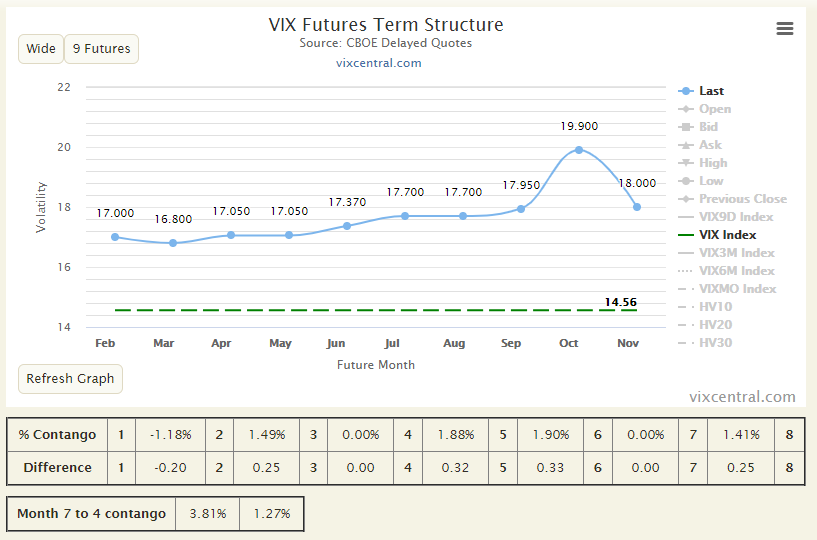

The VX1-VX2 spread has been attracting a lot of attention recently on fintwit. It seems that many have no idea what this spread means, but I am certain that all of you experience this from time to time in your day to day lives – so first I will try to explain it in a way that you can relate to.

The VX1-VX2 spread is simply the front month VIX future less the second month VIX future and reflects basic supply and demand dynamics.

In everyday life, you are probably more certain about what is going to happen next week and next month than in two months, a year two years etc.

This describes a normal vix futures curve. The front month future is priced lower than the second month future which is lower than the third month future etc. This is to reflect the uncertainty of more time.

Other times, and more rarely, the front month future is higher than the second month future (and perhaps the remainder of the curve as well). As of writing this post the front month future is indeed higher than the second month future.

So how does this relate to every day life? There are almost countless examples, but probably the best way to get the concept across is with a joke…

EXAMPLE 1

You are travelling in China and you just ate some bat soup. Unfortunately for you, you contracted the Corona Virus and now have the BSDS (bat soup diarrhea syndrome). You are in a mall and you know you could pay a wage to use the bathroom (they charge for that in China) or you could risk sh*tting your pants on the cab ride home.

It should be obvious what is happening here. You either pay a price (any price) for immediacy or risk paying a much larger price soon thereafter when you potentially shit the cab.

This is the VX1-VX2 inversion in a nutshell. The front month future becomes bid over the second month future because of extreme uncertainty in the near term.

EXAMPLE 2

If you are reading this post there is a good chance you are familiar with the CFA exams. If you are familiar with the CFA exams you know that you can sit for the level 1 twice per year, and level 2 and 3 once per year.

Legend has it that once upon a CFA exam, an unlucky CFA candidate had the pre-exam runs. Unfortunately for this particular candidate there was a massive line up in the bathroom. The candidate quickly realized he had two options. He could sh*t his pants and wait six months to a year to write the CFA exam again…. OR he could not shit his pants. The CFA writer chose option 2, went to the sink, dropped his pants and let loose.

You may be asking yourself “Did he pass?!” The answer. Most likely not. Pass rates are only positive EV for level 3.

EXAMPLE 3

Now if none of that makes sense, here is another scenario, just in case. Your furnace turns off in the dead of Winter it’s -50 degrees outside. What do you do? Do you call the Furnace guy at $1500 to fix your furnace now or do you hope your pipes don’t freeze and call the furnace to come in the morning to fix your furnace at $150?

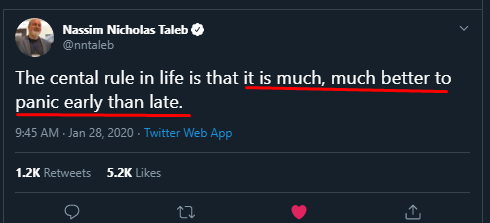

To summarize, the core idea behind VX1-VX2 inversion is that:

Sometimes it is costly – but most of the time relative to the potential alternative, it is not.

There you have it, the VX1-VX2 spread helps you identify when market participants are beginning to panic.

In the next post we will dive into the VX1-VX2 spread data.

Thanks

I like it